Go to Bill Payment search biller name WWF Malaysia. MBB 5621 7950 4126.

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

With effect from the YA 2020 the restriction on that allowable deduction is increased to 10 of the aggregate income of an individual.

. Subsection 44 6 2. A deduction is allowed for cash donations to approved institutions defined made in the basis period for. A list of institutions where donations are eligible for tax benefits under SEC 80G.

Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions. Donations are only tax deductible if they are made to a Government approved charitable organisation or directly to the Government. Been approved under subsection 44 6 of the ita 1967 an approved institution or organisation is prohibited from.

BEEN APPROVED UNDER SUBSECTION 44 6 of the ITA 1967 An approved institution or organisation is prohibited from. Gift of money made to any approved institution organization or fund approved by the DGIR is also allowed as a deduction but restricted to 7 of the aggregate income of an individual. Cash donation paid to approved institutions or organisations Gift of money orcontiibutioninLkino to any sports activity or approved 700 OF sports body Gift of moneyorcostofcontribution AGGREGATE INCOME in-kind to any project of national interest approved by the Finance Minister Gift of artifacts manuscripts or aintings NONE to the.

You can donate to us via our official donation page. The dgir gazettes the name of the institution or organization in the government gazette after the application is approved. Lembaga Hasil Dalam Negeri Malaysia Inland Revenue Board of Malaysia has on 30 January 2020 revised the guidelines for Approval of Director General of Inland Revenue under Subsection 446 of the Income Tax Act 1967 to bring it up to date with.

Investing in subsidiaries with the total number of shares held not exceeding 49 total paid up capital. Any organisation or institution which is approved under subsection 446 will automatically be granted tax exemption on its income except dividend income under paragraph 13 Schedule 6 Income Tax Act 1967. REVISED GUIDELINES BY LHDN FOR ISSUANCE OF OFFICIAL RECEIPT AND TAX EXEMPTION RECEIPT.

Mindful of the speed and scale of response required MERCY Malaysia is launching the MERCY Malaysia India COVID-19 Fund to help them contain this human catastrophe. Amount is limited to 7 of aggregate income Subsection 44 6 3. An institution or organisation or fund that has been approved under subsection 446 of the ITA 1967 is eligible for.

Headquarters of Inland Revenue Board Of Malaysia. Malaysian Red Crescent Society. Gift of money or cost of contribution in kind for any Approved Sports Activity or Sports Body.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. To receive the receipt in accordance with lhdn malaysia regulations. Amount is limited to 10 of aggregate income.

Should an approved institution or organisation or fund reapply for the purpose of contribution donation for COVID-19. TYPES OF INSTITUTIONS OR ORGANISATIONS ELIGIBLE TO APPLY FOR APPROVAL UNDER SUBSECTION 446 OF THE ITA 1967 An institution or. Allocate funds to provide frontliners with face masks COVID-19 test kits and more ventilators to be used by patients in serious conditions.

Tuesday August 2 2016 1016 IST. Investing in subsidiaries with the total number of shares held not exceeding 49 total paid up capital. Malaysian Red Crescent Society is a non-profit organisation dedicated to humanitarian acts and services.

And you must keep the receipt of the donation. Accepting donations from subsidiaries of which the institution or organisation held more than 49 of the paid up capital. Gift of money to Approved Institutions or Organisations.

Institution or organisation or fund approved under subsection 446 of the ITA 1967. Here is the list of contributions under donations gifts. Gift of money to Approved Institutions or Organisations.

Gift of money to the Government State Government or Local Authorities. The Malaysian Red Crescent Society is raising funds to help the affected flood victims around Selangor including those in Klang Shah Alam Hulu Langat. Ahmad has an aggregate income of RM60000 and makes a donation of RM5000 to an approved institution in March 2021.

Bill Payment Available in Maybank2U CIMBClicks and HSBC Online. Heres quick scenario to briefly illustrate how the whole thing works. We urgently need your support to deliver life-saving aid to India.

Speaking at the event its director Dr Huỳnh Nguyễn Lộc said the achievement. You may channel your donation to. Support Us Donations.

List Of Approved Institution For Donation In Malaysia - Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts. Fill up details required by. Offline Donation - Download our donation form here and send it to the address stated in the form.

Malaysia COVID-19 Charity Drive. The vaccine was first approved for emergency use by the us food and drug administration on 11 december 2020 and later by world health organisation who on 31 december 2020. The revised guidelines also states that the approved institution or organisation should not issue official receipts or tax deductible receipts.

At the moment of writing their goal is to raise about S164944 RM501348. The HCM City Traditional Medicine Institute on Friday receives the Labour Order first class in its 46th birthday. Effective from the YA 2017 for the purpose of an approval under.

For example if your chargeable income is RM55000 and youve donated RM2500 to an approved charitable organisation you are allowed to deduct 7 of.

Updated Guide On Donations And Gifts Tax Deductions

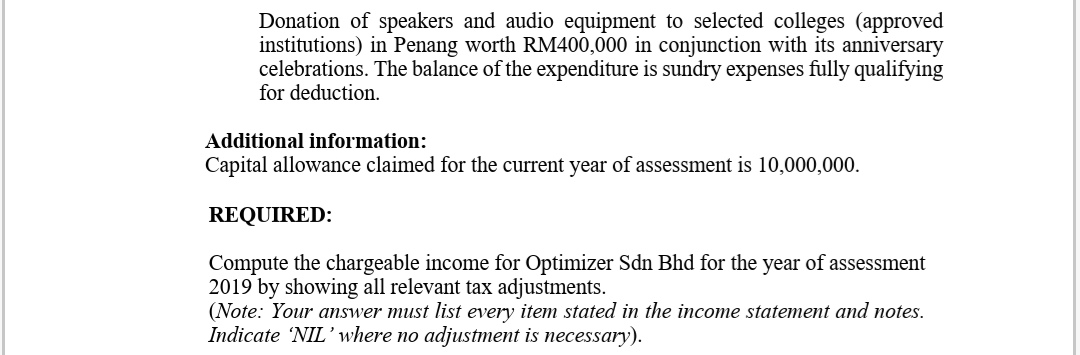

B Optimizer Sdn Bhd Has Been Established For Over 10 Chegg Com

Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts

Claims For Income Tax Relief Malaysia 2022 Ya 2021 Funding Societies My

Updated Guide On Donations And Gifts Tax Deductions

Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts

Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts

Ways Of Establishing A Foundation In Malaysia Azmi Associates

Intention To Voluntary Blood Donation Among Private Higher Education Students Jimma Town Oromia Ethiopia Application Of The Theory Of Planned Behaviour Plos One

Regulatory Requirement For Npos In Malaysia Download Table

Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts

Aggregate To Total Income Acca Global

Here S A List Of Covid 19 Funds You Can Donate To To Help Frontliners And Those Affected Rojakdaily

Pdf Characteristic Affecting Charitable Donations Behavior Empirical Evidence From Malaysia Published In Procedia Economics And Finance

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Don T Fall Prey To The Fake Charity Collectors Here S How To Identify

Beware And Protect Yourself From Covid 19 Related Scams Covid 19 Related Announcements Securities Commission Malaysia

Benderaputih Ngos Charities You Can Contribute To Or Get Help From This Mco Klook Travel Blog